"Локомотив": шансы на еврокубки 2004/05

"Локомотив": шансы на еврокубки 2004/05

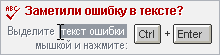

После окончания чемпионата России определилось представительство России в еврокубках в сезоне-2004/05. ЦСКА стартует со 2-го отборочного раунда Лиги чемпионов. "Зенит" и "Рубин" начнут борьбу со 2-го отборочного раунда Кубка УЕФА. Еще одна путевка в этот турнир достанется обладателю Кубка России. Или финалисту, если трофей завоюет ЦСКА. Если же Кубок страны выиграют "Зенит" или "Рубин", четвертая путевка в еврокубки окажется у "Локомотива". Железнодорожники могут попытаться пробиться в Кубок УЕФА через Кубок Интертото, где России будет выделено лишь одно место. В случае отказа "Локомотива" право участвовать в этом турнире получит "Шинник", отмечает "Спорт-Экспресс".

Последние материалы