Этническая толерантность чужда нашим милиционерам. А как насчет культуры мира?

В четверг в здании правительства Москвы на Новом Арбате слушатели курса повышения квалификации "Толерантность, профилактика экстремизма, воспитание культуры мира" получили свидетельства о завершении обучения.

Посещение лекций с чаепитием и беседами "за жизнь" внесло приятное разнообразие в монотонную жизнь сотрудников префектур (именно они стали основными потребителями обязательной 72-часовой политинформации).

Получая заветные удостоверения, слушатели сокрушались, что курсы оказались столь краткосрочными. Что думают по этому поводу сотрудники милиции, прослушавшие курс, узнать не представлялось возможным: ни один из них на Новый Арбат не приехал.

Курсы были организованы комитетом межрегиональных связей и национальной политики города на базе Центра межнационального образования "Этносфера" при поддержке департамента образования Москвы специально "для работников милиции общественной безопасности и других служб ГУВД города Москвы, руководителей и специалистов социальной сферы окружного и муниципального уровня административных округов города".

Одна из сотрудниц префектуры Южного округа, получая удостоверение, произнесла прочувственную речь о том, что эти курсы помогли ей разобраться со всеми проблемами, возникающими на работе. Но при вопросе корреспондента газеты "Известия", что именно она имела в виду, чиновница внезапно смутилась, заторопилась и скрылась. Повисший было в воздухе вопрос, чем же помог национальный ликбез сотрудникам префектур и паспортных столов, несколько прояснила руководитель курсов Марина Мартынова, она же замдиректора Института этнологии и антропологии:

"Курс состоял из лекций по этнополитологии, национальным и конфессиональным отношениям, миграционной политике, психологии и конфликтологии. Оказалось, что сотрудники паспортных столов совершенно не разбираются в современном законодательстве, касающемся мигрантов. С этой точки зрения, они вынесли для себя много полезной информации. Самой острой была дискуссия о том, нужно или не нужно пускать приезжих в Москву. Мнения разделились поровну. Что в общем-то и отражает реальную ситуацию. Конечно, за 72 часа научить чему-то крайне сложно. Не хватало семинаров. И, конечно, нужно расширять круг слушателей", — сказала Мартынова.

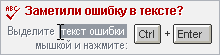

Для работников милиции "Этносфера" выпустила компактное пособие "Практикум межнационального общения", которое легко умещается в планшетке, например, постового. На обложку брошюры вынесена иллюстрация, на которой "лицо кавказской национальности", бодро топорща усы, обнимает щекастого человека в тельняшке и черном берете.

Начинается книга так: "При встрече с представителями других народов нужно быть компетентными и быть знакомыми с их традиционными особенностями, поскольку в каждой культуре существуют свои законы и правила общения. Мудрость межкультурного взаимодействия заключается в том, чтобы не спешить с умозаключениями, когда люди делают, на ваш взгляд, что-то странное, а постараться понять эту культуру".